Semi Annual Compound Interest Calculator Calculate Semi Annual Compound Interest

Next, raise the result to the power of the number of compounds per year multiplied by the number of years. Subtract the initial balancefrom the result if you want to see only the interest earned. The effective interest rate (or effective annual rate) is the rate that gets paid after all the compounding. When compounding of interest takes place, the effective annual rate becomes higher than the overall interest rate. The more times the interest is compounded within the year, the higher the effective annual rate will be.

Growth Chart

At year five the gap in return is more than $2,500 while at year ten it is over $15,000 on that same $10,000 initial investment. For a deeper exploration of the topic, consider reading our article on how compounding works with investments. Note that you can include regular weekly, monthly, quarterly or yearly deposits in your calculations with our interest compounding calculator at the top of the page. The total principal is the sum of the initial value plus any contributions.

Simple Interest vs. Compound Interest

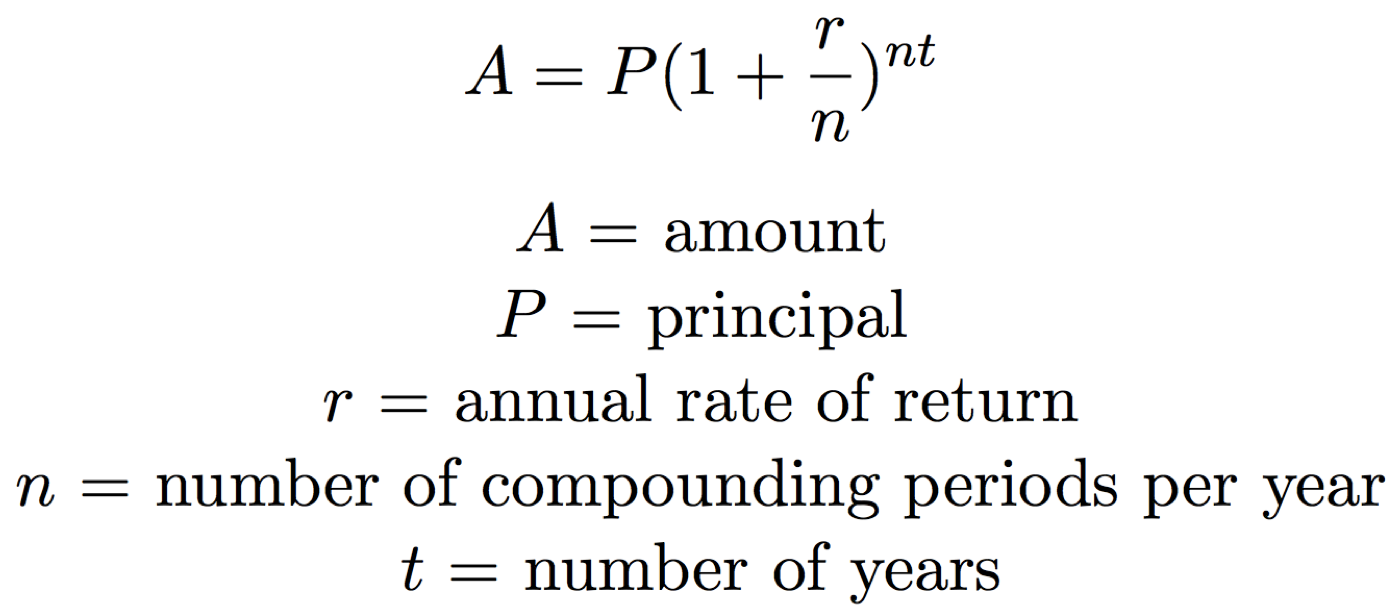

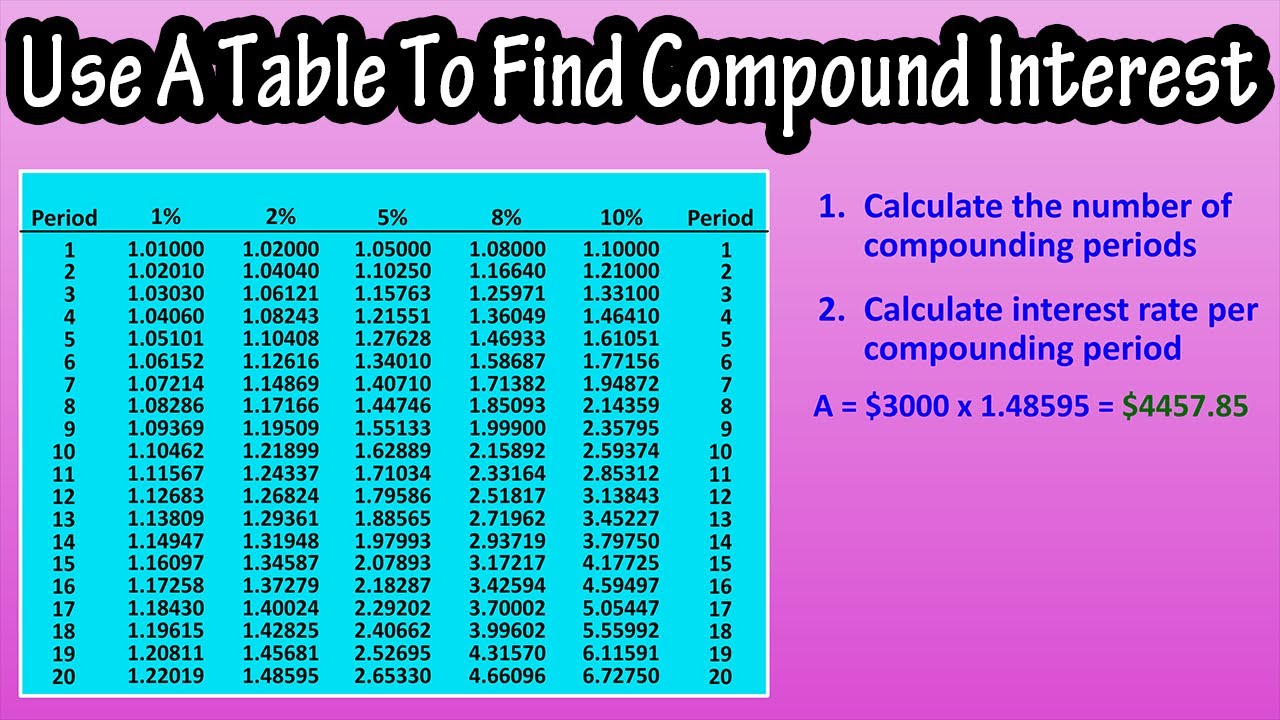

Assuming the returns can be reinvested at the same rate at the end of each year, note how the difference increases as the number of compounding periods goes up. With the compound interest formula, you can determine how much interest you will accrue on the initial investment or debt. You only need to know how much your principal balance is, the interest rate, the number of times your interest will be compounded over each time period, and the total number of time periods. In practice, banks and other investments vehicles use yearly, quarterly and monthly compounding periods, in that order. Banks generally provide saving accounts with yearly capitalization of the interest while investments in stocks that pay a dividend have yearly, quarterly or monthly payments.

Effect of the compounding period

Interest will be earned on contributions, leading to more exponential growth. This means that [latex]0.05\%[/latex] per day is equal to [latex]18.25\%[/latex] compounded daily. You can look at your loan or credit card disclaimer to figure out if your interest is being compounded and at what rate. For our Interest Calculator, leave the inflation rate at 0 for quick, generalized results.

In the short term, riskier investments such as stocks or stock mutual funds may lose value. But over a long time horizon, history shows that a diversified growth portfolio can return an average of 6% annually. The compound interest formula is an equation that lets you estimate how much you will earn with your savings account. It’s quite complex because it takes into consideration not only the annual interest rate and the number of years but also the number of times the interest is compounded per year.

- It is for this reason that financial experts commonly suggest the risk management strategy of diversification.

- When calculating compound interest, the number of compounding periods makes a significant difference for future earnings.

- However, even when the frequency is unusually high, the final value can’t rise above a particular limit.

- After 20 years, the investment will have grown to $673 instead of $300 through simple interest.

- Let’s take a look at what to do when the rate given is not the rate per compound period.

Formula for calculating time factor (t)

This variation of the formula works for calculating time (t), by using natural logarithms. You can use it to calculatehow long it might take you to reach your savings target, based upon an initial balance and interest rate. Youcan see how this formula was worked out by reading this explanation on algebra.com.

The critical difference is the placement of interest into the account. Under simple interest, you convert the interest to principal at the end of the transaction’s time frame. For example, in a six-month simple interest GIC the balance in its account at any point before the maturity date is the original principal and nothing more. In contrast, a five-year compound interest GIC receives an interest deposit into the account at periodic times every year. Once this interest is deposited into the account that interest will begin to earn interest for the remainder of the term of the GIC.

We still want to know how much money we will have at the end of three years, but what happens if we deposit that money at the beginning of each period? All that happens is that in that three-year period, each deposit accrues interest for one more period. Because you deposit $135 right at the beginning, that amount compounds for all twelve periods, and your last deposit of $135 will have the chance to earn interest for the last period. One thing to note is that, because we were given an annual rate and were compounding annually, we were able to plug i and n into the formula directly. Let’s take a look at what to do when the rate given is not the rate per compound period. Looking back at our example, with simple interest (no compounding), your investment balanceat the end of the term would be $13,000, with $3,000 interest.

Compound interest (or compounding interest) is interest calculated on the initial principal, which also includes all the accumulated interest of previous periods of a deposit. Long-term investing can be a great way to save for your future.Use our compound interest calculator to see how your investments will grow over time. ______ Addition ($) – How much money you’re planning on depositing daily, weekly, bi-weekly, half-monthly, monthly, bi-monthly, quarterly, semi-annually, or annually over the number of years to grow. Compound interest takes into account both interest on the principal balance and interest on previously-earned interest.

However, above a specific compounding frequency, depositors only make marginal gains, particularly on smaller amounts of principal. You can include regular withdrawals within your compound interest calculation as either a monetary withdrawal or as a percentage of interest/earnings. We at The Calculator Site work to develop quality tools to assist you with your financial calculations. taxes on sweepstakes prizes worth less than $600 We can’t, however, advise you about where toinvest your money to achieve the best returns for you. Instead, we advise you to speak to a qualified financial advisor for advice based upon your owncircumstances. Unlike simple interest, which is calculated only on the principal, compound interest is calculated on both the principal and the accumulated interest.

In order to calculate the future value of our $1,000, we must add interest to our present value. Because we are compounding interest, we must reinvest our interest earned so that our interest earned also earns interest. In reality, investment returns will vary year to year and even day to day.